Required documents

-

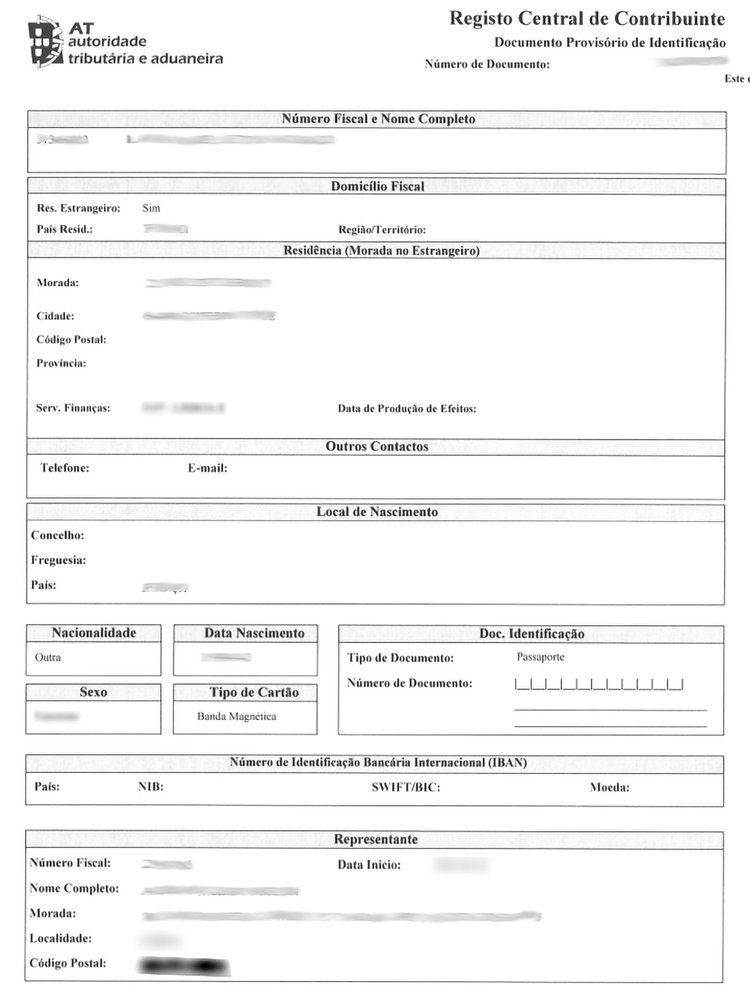

Passport or ID Card

Needs to be at least 3 months away from its expiration date.

-

Proof of Address

Less than 12 months old and emited from an official authority or service provider

-

Power of Attorney Document

We will prepare the document and also get it notarized for you.

-

Having a Fiscal Representative

- We will act as your Fiscal Representative.

- The Fiscal Representation is included in the price.

Contact us

The Residence Permit for Highly Qualified Activities in Portugal is an exclusive visa program that aims to attract exceptional talent from outside the European Union (EU).